P.O BOX 418, SANDTON, GAUTENG

P.O BOX 418, SANDTON, GAUTENG

After completing the inquiry form we will send you a link to our online application form.

As soon as we have received your application we will present you with a car refinance quotation.

Compare your new repayment with your existing instalment and accept our quote.

We will send one of our FAIS accredited agents to you to sign the new agreement, and settle any outstanding amount.

One way to come up with some extra cash is to refinance your car with Refinance My Car. We offer a variety of refinancing options

Extend the term of your current loan for the current outstanding balance (settlement) and reduce your instalments

Refinance your vehicle for its current market value over a longer term, receive the cash difference, and still pay a similar instalment.

If you qualify, you may also be able to

skip your current car payments for as long as 60 days,

giving you time to catch up on those expenses.

This is absolutely the cheapest and easiest way to get cash and consolidate your debt.

APPLY ONLINEIn a nutshell, people choose refinancing as a way to save money. For example, if the existing

car loan rate is extremely high, refinancing is a great way to acquire the best car loan

rate. If your

credit has recently improved, refinancing is perfect. Moreover, if you choose to extend the terms, the new

low-rate car loan will result in a noticeable savings

You might qualify for a better interest rate now so why do you have to pay a higher rate, refinance and save!

GET A QUOTE

By extending your loan or lowering your current interest rate we can reduce your monthly instalment.

GET A QUOTE

You can even get cash out if the market value on your vehicle is higher than the outstanding balance.

GET A QUOTE

Refinance My Car can finance your balloon / residual amount for up to 72 months, at a lower rate and lower instalment.

GET A QUOTE

You can reduce your current residual value to a lower amount, this option will reduce your total contract interest payable.

You can also choose to increase your current residual value if you would like to further reduce your monthly instalment*

Refinance My Car can also refinance your vehicle and totally eliminate your existing residual value.

If your current agreement does not have a baloon value and you whish to add one, you can refinance your vehicle to add a residual amount, once again this will reduce your instalment.

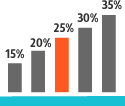

In a nutshell, people choose car refinance as a way to save money and reduce their current interest rate. For example, if the existing car loan rate is extremely high, refinancing your vehicle is a great way to get a better rate. Your credit rating will also improve as your existing loan will be settled in full and you will enter a new credit agreement. If you choose to extend the term of the loan together with a lower rate, you will have a noticeable saving on your monthly instalment.

Your estimated rate will be presented to you as part of the initial quotation. Our rates are very competitive but ultimately the rates are dependent on each individual’s current credit profile, the better your current credit profile, the better your new rate will be.

This is dependent on the vehicle value, any current settlement to a financial institution and ofcourse your existing credit profile. For example, if your car is fully paid up and has a trade value of R100000 you might be able to receive the full R100 000 out in cash. If however your vehicle has a trade value of R100000 and you still owe R50 000 to a bank you will only be able to get R50 000 cash out when you refinance your vehicle.

With Refinance-My-Car both the buyer and seller are protected, making it a safe, simple process. We finance private sales between individuals, companies and trusts, and from deceased estates. We also offer a range of insurance options and can help you with your vehicle’s registration.

Whether you are looking to cruise along the water, crash through the waves or tour around South Africa on four wheels, Refinance-My-Car is the answer.

We offer finance and insurance for new and used:

Shop for your new car with confidence, and count on us to help you organize monthly payments you can afford, as well as secure the lowest interest rates available. We’ll help you with the loan application, review your budget with you, and make sure your money is well spent.